Executive Summary: US adoption of gluten-free diets has remained steady at 6-7% since 2018. However, revenue in the gluten-free market is annually growing at up to 9.7%. Three gluten-free growth strategy examples show how gluten-free is thriving in this challenging reality. We take a deep dive into three cracker brands: NUFS, Mary’s Gone Crackers and Ella’s Flats.

3 Cracker Brands Inflate Gluten-Free Growth, Despite Overall Adoption Flatness

Gluten-free cracker brands like NUFS, Mary’s Gone Crackers and Ella’s Flats are growth strategy examples, despite the fact that gluten as a US dietary focus has been flat from 2018 to 2025, according to IFIC studies that are methodologically consistent.

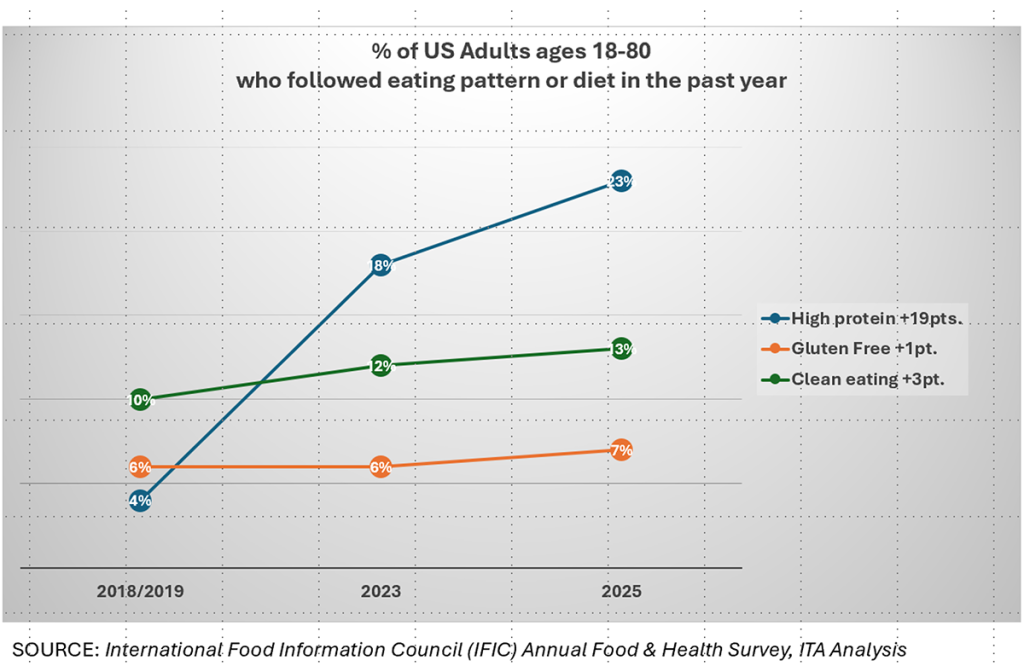

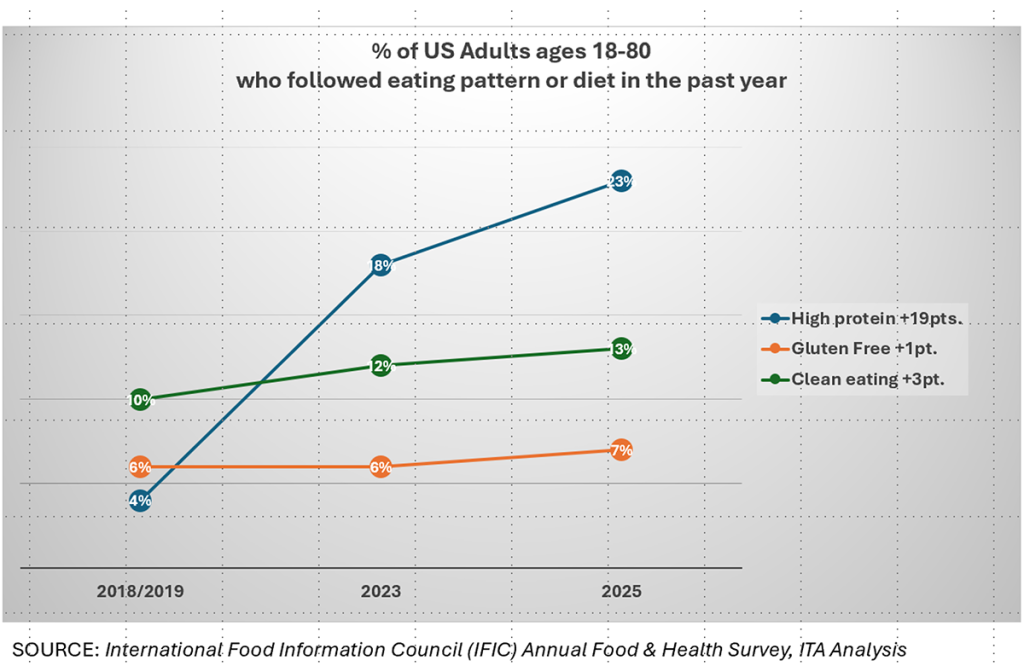

Specifically, from 2018 to 2025:

- The percentage of US adults who followed a gluten-free diet in the past year was flat at 6 to 7% (see orange line below)

- The percentage of US adults who followed a high protein diet (shown in blue) increased from 4% to 23%

- Clean eating also posted gains from 10% in 2019 to 13% in 2025

Looking ahead, perhaps gluten-free will benefit from the anticipated growth in high-fiber diets, with 50% trying to eat high-fiber in 2018 increasing to 64% trying to consume high-fiber in 2025.

Which Products Drive Gluten-Free Revenue Growth?

Looking at revenues, the gluten-free market, led by bakery products grew from 2018 to 2025 despite the lack of growth in diet followers.

- Global Market Insights estimated the US gluten-free market at $910 million in 2018, growing 7 to 10% to in 2025.

- Using a more expansive definition, Grandview Research estimated the US gluten-free market at $2.5 billion in 2025, growing at 9.7% going forward.

Since the percentage of US adults following gluten-free diets is flat at 7%, the dollar growth comes from other factors. For instance, gluten-free products frequently carry a premium price, which explains part of the gluten-free growth in dollars, along with price inflation.

Casual-user consumers who don’t consistently follow gluten-free diets, but who experience benefits from following at times, act to broaden the available market and drive additional purchasing (studies vary on how large the casual user group is).

The largest product category within gluten-free bakery is bread (36% market share in 2021), with cookies and crackers combined at around 15-20%. We draw our growth strategy examples from the cracker category.

In some cases, even higher yearly growth rates are seen. For instance, in 2022, IRI reported the 12 to 21% growth rates for gluten-free perimeter products:

- Gluten-free perimeter cookies: 12% growth to $41.6 million

- Gluten-free perimeter cakes: 21% growth to $33.8 million

- Gluten-free perimeter breads: 14% growth to $21.1 million

Perimeter bakery products are also called in-store bakery or ISB to refer to the section of the grocery store that sells fresh, typically shorter-shelf-life baked goods, as distinguished from center aisle grocery store will longer-shelf-life packaged breads such as Grupo Bimbo’s Sara Lee or Campbell’s Pepperidge Farm.

What’s the Future for Gluten-Free Growth?

Going forward, expectations for gluten-free bakery growth vary, but all sources expect continued growth ranging from a low estimate of gluten-free bakery products in the US at 4.9% CAGR (2023 to 2030) to faster growth in Asia-Pacific, globally (+7.5% CAGR from 2023-2032). Grandview puts gluten-free bakery growth at 10.8% CAGR between 2022 and 2030. If the 4.9% projection is accurate, then after inflation the gluten-free bakery products category will grow around 2%.

Beyond gluten-free interest, specialty crackers, like NUFS, Mary’s Gone Crackers and Ella’s Flats are also benefitting from the consumer trend towards entertaining with charcuterie boards. A food industry expert comments:

“More shoppers are embracing charcuterie as a means to entertain guests instead of single portions. As a result, Natural and Specialty crackers are gaining popularity to provide a more interesting vessel for the more premium meats, cheeses, and spreads.”

NUFS: Gluten-Free Growth Strategy Example

Officially launched in the US in 2022, NUFS is now based now in Austin, Texas. This growth strategy example has a similar origin story to many other healthy brands that are inspired by the medical challenges of a founder or founder’s family member.

For instance, Healthy Choice was created when former Conagra CEO Mike Harper had a heart attack in 1985. Kevin’s Natural Foods was created by Kevin McCray, who found diet helped control his auto-immune disorder.

NUFS was co-founded by two sisters (Jessica and Kristine Tran) whose father was diagnosed with diabetes. Their focus was on better for you: “clean, low-sugar, filling snacks that tasted good.” They committed to avoid common fillers and seed oils and use nutrient-dense ingredients like brown rice, oats, and black sesame seeds.

Jessica Tran is NUFS’ CEO, with a background in media and digital solutions. Kristine Tran is NUFS’ Chief Commercial Officer bringing expertise in sales and finance. Previous to founding NUFS, Kristine was focusing on gluten-free snacks for four-and-a-half years at ENUF foods.

NUFS Brand Promise

NUFS with its “nuffin but the best” focuses on simple, real ingredients. All NUFS products are:

- Low sugar

- Clean ingredients

- Certified gluten-free

- Dairy-free

- Seed oil-free

And, as all food products must do, NUFS signals that it tastes good.

NUFS’ brand promises are flagged on the front of the packaging, as this Hot Honey Crispy Crackers image from the brand’s blog illustrates. Other ingredients highlighted on this growth strategy example are almond flour and olive oil.

The three NUFS brand’s best-selling products are:

- Hot Honey Crispy Crackers

- Everything Bagel Crispy Crackers

- Sea Salt Crispy Crackers

The NUFS standard package size is 4.25 ounces, and the brand also offers snack size 1.03 ounces.

Of these, Hot Honey has 3 grams of sugar per serving, while Sea Salt and Everything Bagel have less than 1 gram. NUFS Everything Bagel has 3 grams of protein, 1 gram of fiber and 7 grams of fat in a 150 calorie serving with 4 servings to the 4.25 ounce box.

NUFS previously sold refrigerated Superfood Energy Bites but discontinued these when their manufacturer filed for bankruptcy and cracker demand far outpaced bites. As Sahar Chmais reported,

“cracker sales quickly eclipsed demand for the energy balls…because NUFS was disrupting a ‘stale category.’”

NUFS Financial Results

NUFS is a small firm and has not publicly released its financial results. Zoom Info estimates the business at $10 million, but other estimates come in at $2 to $3 million.

In late 2024, the brand claimed distribution in 1,000 retail doors. And as of late 2024, Jessica Tran said “the business is on track to hit profitability next year.”

NUFS is funding its growth with self-funding, along with family-and-friends’ investment. Said Kristine Tran:

“I think a big part of the growth is alignment in partners that are aligned in the vision, and also the timeline of how long things can take. So we’ve only done family and friends, but we self-funded it until the beginning of this year.”

NUFS Target Consumer and Marketing

NUFS target consumer is a wellness-minded young adult (Gen Z and Millennial) who cares about ingredients and flavor. This consumer is looking for clean labels and also interesting flavors with a fun snacking experience.

NUFS relies on in-store sampling and promotions for its marketing. The brand first launched in the US at HEB’s Central Market in Texas.

Said Jessica Tran:

“As a retail-first brand where packaging serves as an in-store billboard, we needed something bold and eye-catching. The Working Assembly delivered beyond our expectations. Customers, buyers, and distributors have all praised our sharp new look, and it has helped us secure retail partnerships with major chains like Whole Foods.”

US Retailers carrying NUFS include:

- Central Market

- Hy-Vee

- Sprouts

- Whole Foods

NUFS has used the tagline “nuffin but the best” as well as claims such as “Delicious by choice, gluten free by chance.”

A NUFS Tiktok post highlights how the Hot Honey Cracker successfully disproved the initial feedback of “no one is going to like a spicy cracker.” A December 2025 post showcases a recipe with an elaborately prepared snack using NUFS as the base.

Mary’s Gone Crackers: Gluten-Free Growth Strategy Example

In 1994 Mary Waldner, the founder of the Mary’s Gone Crackers brand, was diagnosed with Celiac Disease at age 43. Waldner (a psychotherapist turned food entrepreneur) was “already a zealot about healthy food,” and “always loved baking.” She faced challenges when going out to eat and thought “I need a snack” to bring along when eating out and saw no good options on the menu.

According to Gardner when she was starting out, “no one had a gluten-free facility” (to manufacture the crackers). For five years, she made them at home, by hand. Finally, she located a commercial facility. And, in 2004, the Mary’s Gone Crackers company opened, with its headquarters in Reno.

Mary’s Gone Crackers Brand Promise

All Mary’s Gone Crackers products share the following attributes:

- “Certified organic

- Gluten-free

- Non-GMO

- Plant-based

- Transparency in sustainable ingredient sourcing”

Carla King, Senior Marketing Manager at Mary’s Gone Crackers described the brand’s point of difference:

“I know some have just come out with an organic line, one of our big competitors has. But we have always been that way and will always be that way. We are very careful in sourcing ingredients and in our packaging. Our goal is to focus on the health of the consumers and the health of the planet as we do that.”

Looking at the box of Mary’s Gone Crackers Original Crackers, additional large claims (beyond gluten free) on the front of the package are:

- Vegan

- Whole Grain (except for Cheezee)

Cracker products featured on Mary’s Gone Crackers website are:

- Original Crackers

- Super Seed Everything

- Real Thin Crackers

- Cheezee

Mary’s Gone Crackers Financial Results

In April 2025, Mary’s Gone Crackers was acquired by Dare Foods from Kameda Seika. While exact figures are not available, Dare Foods revenues are estimated in the $470 million range, as compared with Mary’s Gone Crackers in the $40 million range. Other cracker brands in the Dare Foods portfolio are its flagship brand Breton, as well as Cabaret, Grainsfirst and Vinta.

Previously, Kameda Seika acquired Mary’s Gone Crackers in 2012. As a point of reference, Mary’s Gone Crackers had net sales of $36.3 million in 2023 with net losses of $22.2 million. Said Paul Sinder, SVP Sales, Marketing and R&D at Dare Foods:

“By integrating Mary’s Gone Crackers expertise in premium organic and gluten-free snacks, Dare Foods will enhance its product portfolio and deliver expanded solutions to consumers globally.”

Recent financial results show a return to growth and profitability. Says CEO Michael Finate, CEO of Mary’s Gone Crackers:

“We ended 2024 with record-breaking sales, new customers, a totally reinvigorated product line and a vital transition to profitability in the second half of the year. This positive momentum reflects the strength of our brand, the impact of our strategy, our team’s commitment to continue advancing with humility and the conviction that drives us on this exciting trajectory in 2025, and beyond.”

Mary’s Gone Crackers Target Consumer and Marketing

The initial core consumer for Mary’s Gone Crackers is driven by medical necessity (Celiac disease) to scrutinize labels. This medically-driven consumer also values the “whole food” promise and the transparency in sourcing. Today, the brand also appeals to a broader group of wellness-minded consumers (not with Celiac disease) who “demand transparency” and prioritize trust in ingredients (“real food they recognize”), while seeing a strong connection between physical and mental health.

Recently on Tiktok, Mary’s Gone Crackers is posting a tagline of “Your snack girl era starts here.” Posts show Mary’s products in a variety of “on the go” applications and paired with charcuterie, dips and more. This suggests that Mary’s core target consumer is a woman.

In 2024, Mary’s new packaging line was launched with new graphics and a new 4-ounce box size. Said Finarte,

“Our new packaging conveys the breadth of what Mary’s Gone Crackers offers, especially our commitment to healthy organic ingredients and family farms. Consumers today are more informed and educated than ever before. They want to know exactly what they are putting into their bodies, and this new packaging better highlights all the great ingredients that go into our products as well as our commitment to do the right things for our planet and our families, always.”

As of August 2025, Mary’s Gone Crackers package sizes are now standardized to the 4-ounce and the family-sized 7-ounce for Original and Super Seed Everything flavors. Said Grant Garbinski, director of marketing at Mary’s Gone Crackers:

“Introducing the Family Size is a natural next step in ensuring our consumers have options that meet their evolving needs. As routines pick back up and schedules get busier, we know parents and families are looking for wholesome snacks they can feel good about serving — and this new packaging format delivers on the convenience needs of these consumers.”

From this growth strategy example, we can see that Mary’s is targeting wellness-minded moms with the larger-size packaging.

In 2022, advertising agency High, Wide & Handsome handled the launch of Mary’s Gone Kookies, leading a historical Mary’s branding campaign with the tagline of “Passionately, unabashedly & irrationally obsessive about crispy, crunchy, snacks.” However as of 2026, the cookie line appears to be discontinued, and the tagline has changed.

It will be interesting to see how Mary’s continues its recent growth trajectory, and as a Nevada resident, I am rooting for the brand’s expansion.

Ella’s Flats: Gluten-Free Growth Strategy Example

Ellen Mack of Naples, Florida created Ella’s Flats in 2017. Macks was 58 when she started the company. Her background includes an MBA and time working in a family business and other leadership roles in the community.

Macks came across the inspiration for Ella’s Flats in 2015 from a friend’s recipe. After making a batch at home, she realized the product was unique and delicious. Said Ellen Macks,

“I’ve always loved food, I really care about healthy food…it’s a plant based whole food and I thought, everyone needs this…. A year later I found the most fabulous artisanal baker in Florida, I wanted it to be a Florida product…We’ve built this into seven flavors, and a new mini variety. It’s a crispy, crunchy snack that’s truly life changing.”

Macks cites joining a CPG Retail Ready Facebook Group led by Alli Ball that she credits with providing guidance on a variety of topics. Like the Vistage peer advisory groups that I lead, these CPG leaders gave each other advice and counsel to scale their business and overcome challenges.

Ella’s Flats is a:

“large cracker you can eat as a bread replacement or a snack…full of protein and fiber and absolutely delicious.”

Ella’s Flat comes in a variety of flavors including:

- Everything (the top seller)

- Sesame

- Pumpkin seed

- Carroway rye

- Spicy

- Sweet

As of 2025, Ella’s Flats offers 4-ounce packages of Minis (with 6 grams of protein and 5 grams of fiber per serving) and the original size product in 4.8-ounce package offering 7 grams of protein and 4 grams of fiber (in the everything flavor).

Ella’s Flats Brand Promise

Ella’s Flats defines its own category as “Superfood Seed Crackers.” Ella’s offers the following benefits and attributes:

- Certified gluten free

- Certified Non-GMO

- Grain free

- Paleo

- Vegan

- Keto

- Clean, simple ingredients

- Seeds: small but mighty “just seeds, no fillers”

- Fits all diets and lifestyles, i.e., “Ella’s Flats are Certified Gluten-Free and fit any diet and lifestyle: Low carb, keto, vegan, paleo, whole30, gut healthy, blood sugar stabilizing, balancing hormones”

- “Nutrition at its best”

Looking at the nutrition, Ella’s delivers 7 grams of protein per serving and 4 grams of fiber in the Everything variety. Says Mack:

“We deliver the most protein per serving on the shelf…#1 is the taste.”

The first eight ingredients on Ella’s Everything ingredients list are seeds: sunflower, pumpkin, flaxseed, chia, sesame, black sesame and poppy seeds.

Ella’s repeatedly touts itself as a “pantry staple,” more than just a cracker.

In the Carson City, Nevada Raley’s, Ella’s Flats is shelved in a separate healthy snacks section with other seed products, granola, “power snacks,” hemp snacks. It’s not in the cracker aisle, where Mary’s Gone Crackers and most crackers are found.

A food industry expert comments about this placement:

“I have a love hate relationship with isolated BFY sections. They made sense 10-20 years ago but these days consumers just want like items by like. They expect to see the healthy with the regular stuff. So often buyers and planogram folks get caught in their own world that they don’t stop and think of things from the customers perspective.”

Ella’s Flats Financial Results

Since Ella’s Flats is privately-owned, there is no publicly-available information on its sales. Zoom Info estimates the revenues at less than $5 million. It’s interesting that this estimate is less than the estimate for NUFS, since Ella’s Flats was carried in 2,000 stores as of 2023 while NUFS was in 1,000 in late 2024.

Another estimate places Ella’s revenues at estimated $400,000 in Amazon and direct-to-consumer sales and another $2.6 million in retailer sales for a total of $3 million. This is using the price paid for $6.99 at Raley’s, less a 35% retailer margin.

In January 2026, Ella’s Flats claimed #1 product sold by units in its category in Popup Grocer, making it an excellent gluten-free growth strategy example.

Ella’s Flats Target Consumer and Marketing

Ella’s founder Mack and her marketing team are focusing on a broad consumer target of adults who are looking to control their hunger with these satisfying and healthy snacks.

“Everyone loves these…broaden to your widest market…because everyone loves Ella’s Flats, male and female, all ages.”

Ellen Macks describes how Ella’s Flats gained distribution and grew:

“I drag people out of the aisle at the food shows and give them a tasting of the product…So the beginning of it was those first anchor chains who brought us in, got us into the distributors.

“That led then to getting into a broker network of brokers who are our sales team who have those relationships with those buyers who have those relationships in that particular city, region, town…The broker goes and shows that product and helps us with that process of submitting to that category manager.

“Some you can submit to all day long… smaller independent grocery stores. When you go to Whole Foods…Raley’s…are on very strict annual category review schedules….the broker knows that…we send samples…they evaluate our sales, success and product itself and hopefully gives us the go ahead…it usually takes several pings….we are trending on the front end of the cracker category…clean, simple, protein, fiber and more importantly, taste.”

Since 2023, Ella’s Flats’ marketing leader is CMO Martine Lund Nielsen. Nielsen is based in Los Angeles, with previous experience in marketing in Oslo, Norway working with Red Bull and other brands.

Like other growing CPG brands, such as Goodles that we recently profiled, Ella’s Flats uses influencer and micro-influencer marketing. Ella’s Flats Tiktok channel showcases user-generated content. And founder Ellen Mack regularly appears on industry podcasts to share the origin story and create connections.

Product Comparison of Our Gluten-Free Growth Strategy Examples

With the trends towards high-protein and high-fiber demand increasing, Ella’s Flats is delivering the best of these three growth strategy examples for consumers following high protein and fiber diets. We compared Ella’s Flats Superfood Seed Crackers to Mary’s Gone Crackers Superseed Classic Crackers. While Ella’s has a higher price at the shelf, on a per-serving basis they are comparable.

| Gluten-Free Brand and Product | Mary’s Gone Crackers Superseed Classic Crackers | Ella’s Flats Everything Superfood Seed Crackers |

| Package Size | 4-ounce | 4.8-ounce |

| Price at Raley’s | $5.49 regular price | $7.99 regular price $6.99 with loyalty program |

| Calories per serving | 150 calories | 170 calories |

| Protein per serving | 5 grams | 7 grams |

| Fiber per serving | 3 grams | 4 grams |

| Total sugars | 0 grams | 0 grams |

| Sodium per serving | 280 mg | 270 mg |

| Total fat per serving | 7 grams | 14 grams |

| Servings per container | 4 | 5 |

| Serving size | 12 crackers | 3 flats |

| Cost per serving | $1.38 | $1.40 |

| Price per ounce | $1.37 | $1.46 |

The Ella’s Flats cracker is a much larger cracker (see photo below), with more visible seeds. In our home taste test, Ella’s is saltier (though sodium is the same) and less dry. Mary’s Superseed is a smaller cracker with more crunch.

These gluten-free growth strategy examples demonstrate that brands have been growing despite the overall relative flatness of the gluten-free market. And they bring benefits beyond gluten-free. Ella’s Flats seems the most on-trend with their high protein and fiber content.

For more growth strategy examples, visit our resources page. Subscribe to our newsletter, or contact us to talk to the Insight to Action experts about your brand.