Executive Summary: In this article, we describe the effects of GLP-1s on the food and beverage market by examining how different brands have approached marketing to GLP-1 users. Three growth strategy examples from Conagra, Danone, and Nestlé show that growth strategy depends heavily on starting position.

New Products like Oikos Fusion, Healthy Choice & Vital Pursuit Appeal to the Nutritional Needs of GLP-1 Users

After Ozempic was approved for weight loss in 2021, GLP-1 drugs have seen a meteoric rise in popularity. A recent poll shows that 12% of Americans reported having taken these medicines. We can see the effects of GLP-1s whenever we turn on the TV to a slightly thinner world of actors.

But what about when we visit the supermarket? Food Business News reports that GLP-1 consumers spend on average 6% less when they visit the supermarket, which could present a challenge. However, in the same article we see that “nutrient dense options” are least affected by this trend.

The story doesn’t end with decreased spending, however. Related to the adoption of GLP-1 drugs, Oklahoma State University reports:

“protein-rich foods continue to experience greater demand growth relative to other food categories.”

Progressive Grocer reports:

“weight-loss focused [GLP-1] users increased their spending in health-related categories… [and] behavior shifts persist even when GLP-1 usage lapses.”

Similarly, PreScouter notes that while GLP-1 drugs might trigger decreases in some industries, they also might create opportunities for growth strategy examples in health-supportive industries. In short, GLP-1 drugs represent both a challenge and an opportunity in the food and beverage industry.

Today’s growth strategy examples reflect the different ways that different companies have chosen to respond to this new challenge cum opportunity. Danone, Conagra, and Nestlé are all positioning themselves to capitalize on a new group of consumers, and each of the three corporations has chosen a slightly different growth strategy. These strategies reflect their different starting positions in the packaged foods space, and demonstrate the way in which innovation lies along a spectrum from incremental to truly radical.

Danone Targets GLP-1 Consumers with New Products: Growth Strategy Examples

The first of our three growth strategy examples comes from the Danone corporation. Danone North America has a full web page devoted to marketing its products to GLP-1 consumers.

Danone lists the following products as “GLP-1 friendly:”

- Oikos Protein Shakes

- Oikos Pro Shots

- Oikos Fusion Drinks

- Oikos Pro

- Oikos Triple Zero

- Light + Fit Greek

- Too Good & Co. Zero Sugar

- Too Good & Co. Blended

Danone has identified products from three different brands as GLP-1 friendly: Oikos, Light + Fit, and Too Good & Co. We can also see that Danone chose to create a new product explicitly aimed at GLP-1 consumers, the Oikos Fusion drink. Oikos is a pre-existing yogurt brand. On the Oikos website, Oikos Fusion drinks are touted as:

“designed to help build and retain muscle mass during weight loss.”

“[Oikos Fusion] is the first and only product in the yogurt category specifically created and positioned to support the unique nutrition needs of GLP-1 users and other weight loss consumers.”

The Danone growth strategy is twofold, therefore: they are making sure consumers know some existing products and brands are GLP-1 friendly, and also creating new products targeted at GLP-1 users.

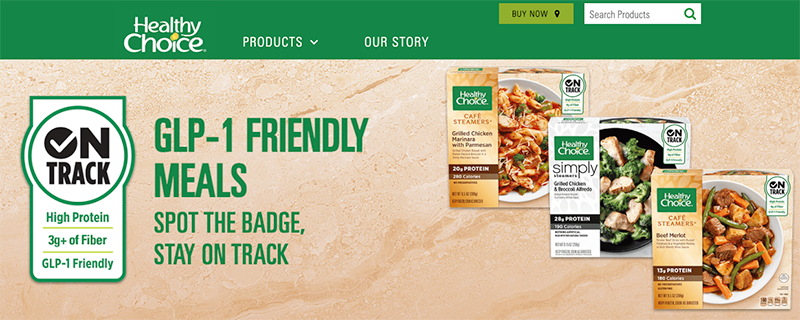

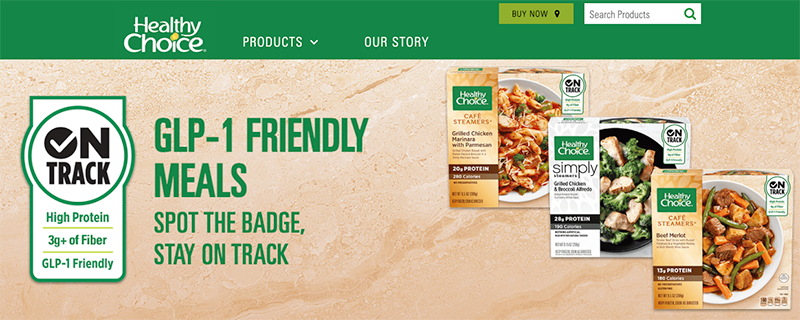

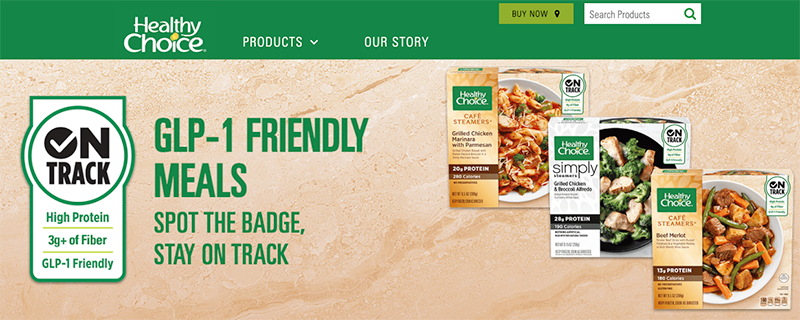

Conagra Re-Labels Existing Products: Growth Strategy Examples

While Danone expanded its Oikos protein lines to include a specifically-formulated product for GLP-1 users, other companies in the food and beverage space are re-labelling existing products to highlight their suitability for consumers on Ozempic and similar drugs. Conagra, for example, has changed the packaging of some Healthy Choice meals to include a “GLP-1 friendly” label. This label will highlight the protein and fiber content of selected meals, as well as directly claiming that they are GLP-1 friendly. According to industry magazine Food Dive, Conagra:

“is confident that the use of GLP-1 medications to lose weight is more than a fad and will continue to increase.”

Nestlé Goes All-In: Growth Strategy Examples

Finally, Nestlé has gone one step further than either Danone or Conagra in marketing its products to GLP-1 users. They have created an entirely new line of products with the brand name Vital Pursuit. This name seems to reflect the hopes of GLP-1 users, who are seeking a healthier lifestyle.

In a press release, representatives of Nestlé wrote:

“Vital Pursuit will help meet this need through a variety of frozen formats such as bowls with whole grains or protein pasta, sandwich melts, and pizzas, all for a suggested retail price of $4.99 and under.”

According to the same press release,Vital Pursuit will become available in North America by Q4, with 12 SKUs including two frozen pizzas. As reported by Dairy Foods, the Vital Pursuit pizzas will be “the highest protein pizzas on the market.”

GLP-1 Growth Strategy Examples: Pros and Cons

We can see that each corporation has taken a different tack. Nestlé seems to have taken the biggest risks by introducing an entirely new brand, whereas Danone and Conagra have only introduced new products or simply relabeled existing products.

Let’s compare Nestlé’s strategy, the most ambitious, to that taken by Danone and Conagra, which are more similar to each other. We can see at least three disadvantages.

- Nestlé will face a disadvantage with Vital Pursuit not faced by either Oikos or Healthy Choice in that Vital Pursuit does not benefit from brand recognition.

- Nestlé’s approach is more costly: everything I wrote about the benefits of incremental innovation reducing cost applies more to the strategy taken by Danone and Conagra than it does to Nestlé here. Putting a new label on an existing product or even formulating one new product in an existing line is a much less expensive way to reach a growing market than creating a new brand with 12 new products.

- Nestlé has an existing weight-loss brand: Lean Cuisine. This makes introducing a new weight-loss brand targeted at GLP-1 patients all the more risky, as it would be disadvantageous if Vital Pursuit competed with Lean Cuisine for the same customers.

Nestlé is a growth strategy example for a reason, though. There are several possible advantages to their risky strategy.

- With good advertising, Nestlé can make clear that Vital Pursuit products are GLP-1 friendly and associated with GLP-1 drugs in particular.

- Weight-loss products have existed for decades, and consumers might associate previously-existing weight-loss products with failed attempts to lose weight. Consumers might have bought Lean Cuisine during previous, failed diets. With a new brand, Nestlé can shed that baggage and associate itself with the new ‘wonder-drug.’

- Gendered branding also comes into play: the packaging of Lean Cuisine is gender neutral or even feminine, whereas Vital Pursuit has several products packaged with a black bar across the top reading “Max Pro:” this clearly seems to be an appeal to young men.

Furthermore, it is true that GLP-1 drugs make room for products that might not have made sense without the drugs. Most weight-loss regimes must focus on foods that punch above their caloric weight in promoting satiety. GLP-1 drugs promote satiety themselves (this seems to be their mechanism of action), so the food consumed need not promote satiety as much. The focus with GLP-1 friendly foods is more to pack enough nutrition into the smaller portions that patients on GLP-1 drugs can tolerate. While existing products might also fit the needs of GLP-1 patients, it does make good sense to create new products and even new brands for GLP-1 patients specifically.

A word on Conagra’s re-labeling strategy, which is the most conservative of the three: Healthy Choice was not originally a diet brand. As covered in a 1992 New York Times article, Healthy Choice began after then-CEO of Conagra, Charles M. Harper, had a heart attack. Healthy Choice was intended to provide frozen, heart-healthy foods (lower in sodium, fat, and saturated fat) without sacrificing flavor or convenience. With this in mind, the more conservative re-labeling strategy makes sense: if Healthy Choice consumers are looking to maintain health as opposed to losing weight, formulating new products appropriate for weight-loss might muddle the Healthy Choice brand. By simply re-labelling some existing products, Conagra can appeal to new customers and continue to appeal to their existing customers (who may also be on GLP-1 drugs) without substantially altering their brand reputation.

Growth Strategy Examples: Two Takeaways

From all of this analysis, two major takeaways emerge:

- Incremental innovation lies along a spectrum

- Growth strategy depends on starting positon

What is the Incremental Innovation Spectrum?

Let’s first discuss incremental innovation, which I covered in my last article. From these three growth strategy examples, we can actually see that innovation lies along a spectrum from incremental to disruptive. Part of developing a good growth strategy involves identifying how much innovation is appropriate at a given time.

Below, we can imagine ConAgra, Danone, and Nestlé fitting along a spectrum of innovation, from most incremental to most risky. We can also see that none of the positions taken by all three of these major and longstanding corporations is the most radical possible growth strategy, which is to create an entirely new business.

Why Does Growth Strategy Depend on Starting Position?

Seeing the spectrum of innovation leads us to our next major takeaway from these three growth strategy examples: a good response to a market trend depends on a given company’s starting position. As detailed above, because ConAgra’s Healthy Choice is not a diet brand, ConAgra might not choose to move into the GLP-1 weight-loss space too aggressively.

Danone, by contrast, is already in a good position when it comes to GLP-1 drugs, especially with Oikos. Because protein is so central to what GLP-1 consumers are looking for, and Oikos already had high protein yogurt offerings, it was probably easy for Danone to slightly reformulate existing products to create a new product, and market their existing products as GLP-1 friendly.

Finally, Nestlé has taken the greatest swing, but they also must be careful not to compete with their existing weight-loss brand, Lean Cuisine. One way they can do this is by differentiating Vital Pursuit from Lean Cuisine as markedly as possible. The way each corporation has entered this new niche reflects their existing brand and product portfolios.

If you are interested in growth strategy, Insight to Action is a leader in this space. Our founder, Michal Clements, whose insights contributed significantly to this article, has over 30 years of experience in the food and beverage market strategy, and the team has recently been focusing on protein and weight loss in the food and beverage industry.

For more information on growth strategy examples, new product examples, customer segmentation, positioning strategy, and more, see Our resources page. Our newsletter is your go-to source for the ever-evolving world of market strategy. Or contact us to start a conversation about your brand.